Small companies with no or bad credit scores to pay significantly more on their energy bills

Small companies who’ve just started trading and have little credit history, or those having quite a bad credit score, could be facing some significantly higher energy-related costs, a new report by price comparison service Makeitcheaper has revealed.

The study reveals that companies who have very little credit history (often because they’ve just started trading) or bad credit scores often have to pay some significant deposits when getting into a new contract with an energy supplier, which can singficantly affect cashflow for said firms.

Jonathan Elliott from Makeitcheaper believes that it’s extremely important for firms know their credit score so they can fix any problem that could lead to them paying a premium for energy.

He said: ‘There are several agencies that calculate scores and the information they use is not always consistent. Some will give new businesses the benefit of the doubt or use the owner’s personal credit rating to calculate a score. Others will keep a limit on a new company’s score until it builds up some trading history.’

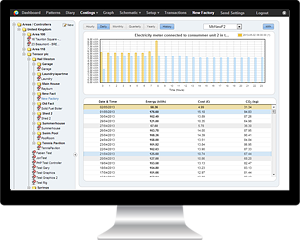

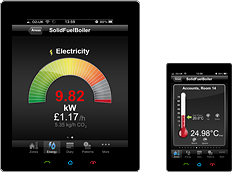

Implementing an efficient Building Energy Management System is one of the most effective methods for companies, as well as home owners, to cut their overall energy bills.

Building Energy Management Systems are capable of delivering extensive monitoring and control options, compared to basic controls. They typically employ data from a variety of sources (boiler flow and return sensors, internal and external temperature sensors, occupancy sensors, humidity sensors, etc.), and enable the perfect optimization of a building’s boiler-based central heating system.

If you’d like to find out more about the savings enabled by the HeatingSave Building Energy Management System, just contact our dedicated product team, they’ll be more than happy to answer all of your questions and queries.