Charities slash costs by automatically dropping the heating when unoccupied

The UK Treasury will fight to keep reduced-rate VAT for green goods on domestic but not charitable buildings. It said it has “reluctantly accepted” charitable buildings will have to pay the standard VAT rate from summer 2013 after accepting the EU’s argument that the tax relief was “too wide”. As confirmed in the Budget 2012, HM Customs and Revenue said it would withdraw the reduced rate for energy saving goods installed in buildings used for a charitable purpose.

The UK Treasury will fight to keep reduced-rate VAT for green goods on domestic but not charitable buildings. It said it has “reluctantly accepted” charitable buildings will have to pay the standard VAT rate from summer 2013 after accepting the EU’s argument that the tax relief was “too wide”. As confirmed in the Budget 2012, HM Customs and Revenue said it would withdraw the reduced rate for energy saving goods installed in buildings used for a charitable purpose.

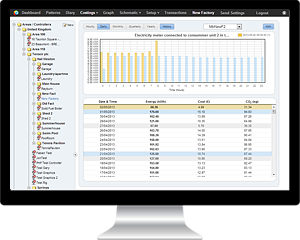

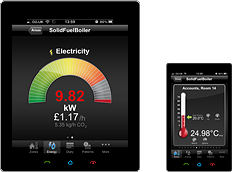

Charities expecting a hike in energy costs can turn to HeatingSave’s smart microprocessor controller to cut heating bills and save money. The premises of small businesses are sometimes more ‘variable occupied’. HeatingSave Small Business automatically drops the heating when buildings are unoccupied, so all the more reason to install it. Even if your heating bill is only £2,500 per annum you could still be looking at a payback of less than three years, and much sooner if the cost of energy goes up further.