Buy-to-let landlords can claim tax relief on energy efficiency measures

Buy-to-let landlords who decide to improve their properties’ energy efficiency levels can easily claim back tax after carrying out the works, but the deadline for the scheme is approaching fast, with little over a month to go.

The tax relief amounts to £1,500 per property, while landlords can also access a further £5,600 of Green Deal cashback.

Landlords have three years in which to make home improvements before new energy efficiency rules come into force. Their costs could run into tens of thousands of pounds and are most likely to affect Victorian and Edwardian properties, thought to make up 10pc of the rental market.

Currently, landlords can claim income tax relief using the Landlords Energy Saving Allowance, but the perk is due to expire on April 6 .

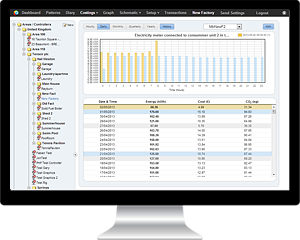

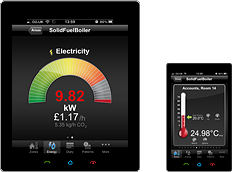

HeatingSave – easy to retrofit, can help landlords and tenants save energy and money

The HeatingSave Building Energy Management System helps customers save more than 30% on their bills by optimizing any heating system’s overall functionality. This is done by taking into account a variety of factors, such as internal and external temperatures, occupancy, time of the year, the particular characteristics of installed boilers, etc.

All of the data is used in order to determine the best heating patterns for the various heating zones within any building, using our proprietary heat-loss algorithm.

HeatingSave is also approved to work and save fuel within the Energy Technology List, which is managed by the Carbon Trust on behalf of the Government. It is also approved by the Department of Energy & Climate Change and the Energy Savings Trust and was specified by the Building Research Establishment for the energy efficient homes retro-fit program, called The Greenhouse Project.

Last, but certainly not least, it’s important to mention that HeatingSave is a component part of the Government’s Green Deal program.

If you’d like to find out more about HeatingSave’s accreditations, just visit the dedicated section on our website, and for any other information, just get in touch with our dedicated product team.