Building industry urges Government to lower Green Deal interest rate in order to boost adoption

The UK Green Building Council (GBC) is urging the Government to lower the Green Deal interest rate in order to boost the adoption of energy efficiency measures, a brand – new report in the business media has revealed.

The industry body points out that, despite close to 100,000 assessments being carried out, less than 1,500 households have signed Green Deal plans and under 500 homes have actually installed energy saving measures using the finance.

Additionally, the UK-GBC believes that although the interest rate – currently 8-10% – is not necessarily the main issue preventing consumers from signing up to the scheme, lower rates could boost uptake. Plus, the organization also suggested that the Government should allow some flexibility, which would reduce the interest rate and give householders the choice to repay loans more quickly and cut the overall amount paid.

On the other hand, Energy Minister Greg Barker said consumers will soon be able to get cash for installing energy efficiency measures within a day in a bid to boost uptake. It will be rolling out a “street-by-street model”, which he believes will be critical to the long term rollout and put “rocket boosters” under the Green Deal.

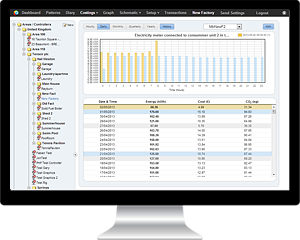

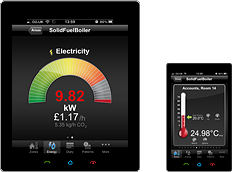

HeatingSave is also approved to work and save fuel within the Energy Technology List, which is managed by the Carbon Trust on behalf of the Government. It is also approved by the Department of Energy & Climate Change and the Energy Savings Trust and was specified by the Building Research Establishment for the energy efficient homes retro-fit program, called The Greenhouse Project.

Last, but certainly not least, it’s important to mention that HeatingSave is a component part of the Government’s Green Deal program.

If you’d like to find out more about HeatingSave’s accreditations, just visit the dedicated section on our website, and for any other information, just get in touch with our dedicated product team.

Leave a Reply